11th January 2023

Banish Blue Monday with top tips and resources from Faithworks CMA team

Blue Monday – i.e. the day the credit card bills arrive after Christmas. Combined with the January weather and short daylight hours, it’s not surprising the third Monday of January gained this nickname.

At Faithworks we believe there is always hope and taking practical steps to address debt and managing money more effectively can enable a sense of calm to return. So at the start of 2023 here are our top four steps you can take if you are struggling with money.

- Maximise your income with a benefits check

“It’s a common misconception that benefits are only available if you’re out of work – but even some families with an income of £50,000 or more can qualify for help.” – Moneysavingexpert.com

It is always worth checking whether you are eligible for benefits. You can do this online by going to Turn2us or Entitledto (see below).

Dawn from the CMA team explained: “We recently supported a couple who are both in full-time employment. They completed an online benefits check on Turn2us which advised they may be entitled to Universal Credit.

They submitted an application and now receive around £78 per month in Universal Credit. This also means they may be eligible for other help including the Cost of Living payments.”

2. Track your income and outgoings with a workable budget

One of the most effective things you can do is to create a budget sheet and stick to it. Once everything is written down, there are less likely to be surprise costs and larger expenses can be budgeted for over the whole year, making these more manageable.

You can download our Managing My Money leaflet below which includes a budget sheet.

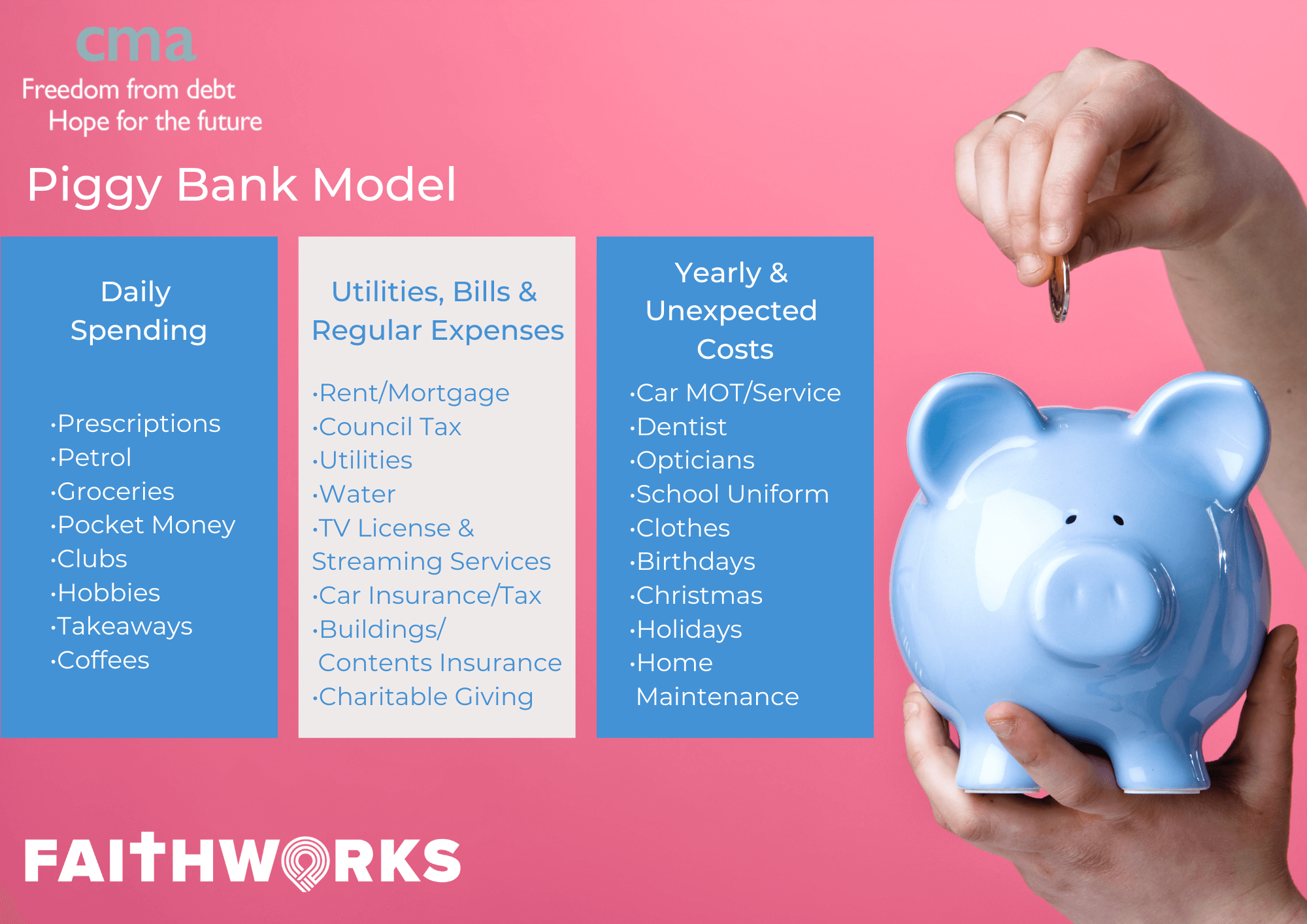

3. The Piggy Bank model – managing money for all eventualities

This is a practical way to ensure that money is set aside throughout the year for all expenses, whether recurring or unexpected.

Using this method you have three separate accounts (virtual jam jars):

- Account 1 Daily Spending – all money is paid into this account. Money is then transferred to the other accounts to cover bills or put aside for yearly or spontaneous purchases.

- Account 2 Bills – all standing orders and direct debits go out of this account for bills, subscriptions, insurance and essentially any ongoing costs.

- Account 3 Yearly and Unexpected Costs – this account is to budget for annual expenses such as Christmas, birthdays and MOTs. It is also to put money aside for unexpected costs that may arise during the year.

*When money is needed from this account, transfer this across to Account 1 for daily expenditure. This should mean that you have the money when the need arises.

4. Try to reduce your spending

“Look after the pennies and the pounds will look after themselves” – famous proverb

Food:

- Shopping around or buying own brands can help cut the cost of food.

- Planning ahead by writing a week of meals to make the most of the food you buy and bulk buying can also help save money.

- Plan meals around leftovers. For example, if you have some spinach that needs eating making a spinach and lemon risotto is a relatively cheap meal while ensuring no food goes to waste.

Transport:

- Walking instead of driving or taking the bus is both good for the wallet and healthy!

Bills and subscriptions:

- Do a health check on all the subscriptions you have – do you still use all the services you pay for? Are there any you could cancel?

*Beware of cancelling mid contract as you may have to pay a cancellation fee. - Internet and TV – are you able to find cheaper deals?

- Car and home insurance – using a comparison site can help find the best deals.

Bills and subscriptions:

- Do a health check on all the subscriptions you have – do you still use all the services you pay for? Are there any you could cancel?

*Beware of cancelling mid contract as this can mean you have to pay a cancellation fee. - Internet and TV – are you able to find cheaper deals?

- Car and home insurance – using a comparison site can help find the best deals.

Debt:

- Debt – if you have debt that you need support with our CMA (Community Money Advice) team may be able to help you. Simply fill out the contact form below or phone our office on 01202 429037.

- Alternatively free debt advice is available from Stepchange and National Debtline below.

Household income:

- Do you have anyone over the age of 18 in your household who could be contributing towards the family income?

Useful resources and websites:

- BCP Council and Dorset Council Cost of Living web pages – includes information on support with the cost of living, energy and utility bills, benefits, grants and payments, childcare costs and more.

- Citizens Advice – information and links to other support agencies on their sites. See below for links to local sites – Citizens Advice Central Dorset includes Weymouth, Dorchester, Sherborne and North Dorset.

- BCP Council Family Information Service – details on childcare, activities and local services.

- Worrying About Money leaflet – find out what options and local support is available. Download this from the Money section on our Need Help Now page below.